In Wisconsin, Tax Increment Financing (TIF) is THE most powerful local tool to guide investment and growth in ways that benefit the community.

Wisconsin’s TIF law is in some ways very rigid and in other ways very flexible regarding how communities can set up and utilize TIF districts. And it is complex, with many types of amendments and enhancements. Getting the most out of your tax increment district (TID) opportunities means being smart about when and how you open, manage, amend and close your districts.

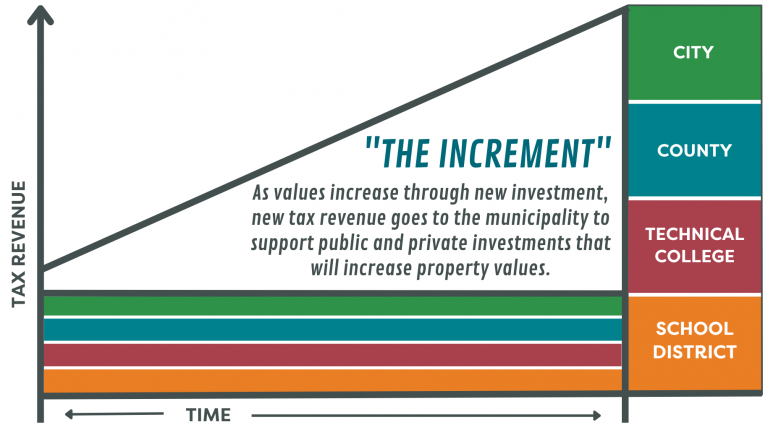

TIF 101

When Wisconsin’s TIF law was adopted in 1975, it was created as a financial tool for municipalities and towns to promote tax base expansion, job growth, economic development and urban renewal. The TIF mechanism allows for the costs associated with economic development of a specific defined geographic area (the tax increment district or TID) to be funded with any increase in property tax revenue or “tax increment” generated from increased property values or “value increment.”......more

Ken Notes: A must read! I would add one thing... Development Agreement, Development Agreement, Development Agreement!!

Share this article on you social outlets

Our Sponsors

- - Volume: 11 - WEEK: 4 Date: 1/25/2023 4:30:25 PM -